How Fiscal Drag Is Costing Your Estate Thousands

What’s Happening with Inheritance Tax?

Figures released by HMRC on 31 July 2025 show that the government collected £6.7 billion in Inheritance Tax (IHT) during the 2022/23 financial year – up from £6 billion the year before. And the trend is set to continue.

According to the Office for Budget Responsibility, 9.5% of estates are expected to be subject to IHT by 2029–30. That’s more than double the percentage from 2021–22 (4.62%).

So, what’s causing this dramatic rise?

Fiscal Drag: The Hidden Tax Trap

The main culprit is something known as Fiscal Drag – a quiet but effective form of taxation.

What Is Fiscal Drag?

Fiscal Drag happens when tax allowances and thresholds stay the same while inflation rises. Over time, more of your money becomes taxable – without the government ever raising official tax rates.

Put simply: your tax bill goes up, even if your income or wealth doesn’t.

The Inheritance Tax Threshold Freeze

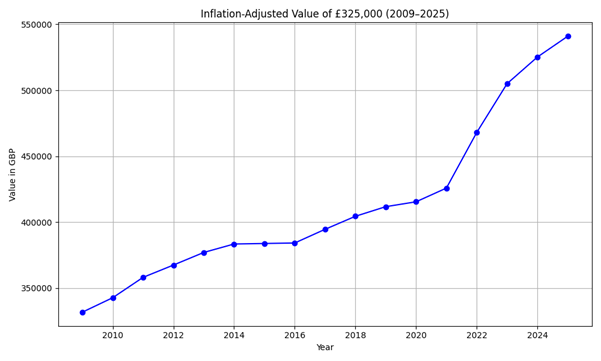

The IHT nil-rate band – the amount you can pass on tax-free – has been frozen at £325,000 since 2009. Meanwhile, inflation has marched on.

Had the threshold kept pace with the Consumer Price Index (CPI), it would now stand at £504,513.

That’s a difference of £179,512 per estate – potentially costing families tens of thousands of pounds in unnecessary tax.

This graph demonstrates the effect of inflation on the IHT allowance.

The impact of inflation on the IHT allowance over time.

Why It Matters – and What You Can Do

This freeze means more families are being dragged into paying inheritance tax, often without realising it.

Estate planning can help reduce your exposure. A well-structured will and the use of tools like lifetime gifting, trusts, and residence nil-rate band allowances can all make a difference.

Talk to Us

If you’re concerned about how inheritance tax could affect your estate, we’re here to help. At Oracle Law, we provide clear, compassionate advice to help you plan ahead.

📞 Call us on 0141 404 1091 or visit our contact page to speak with one of our team.